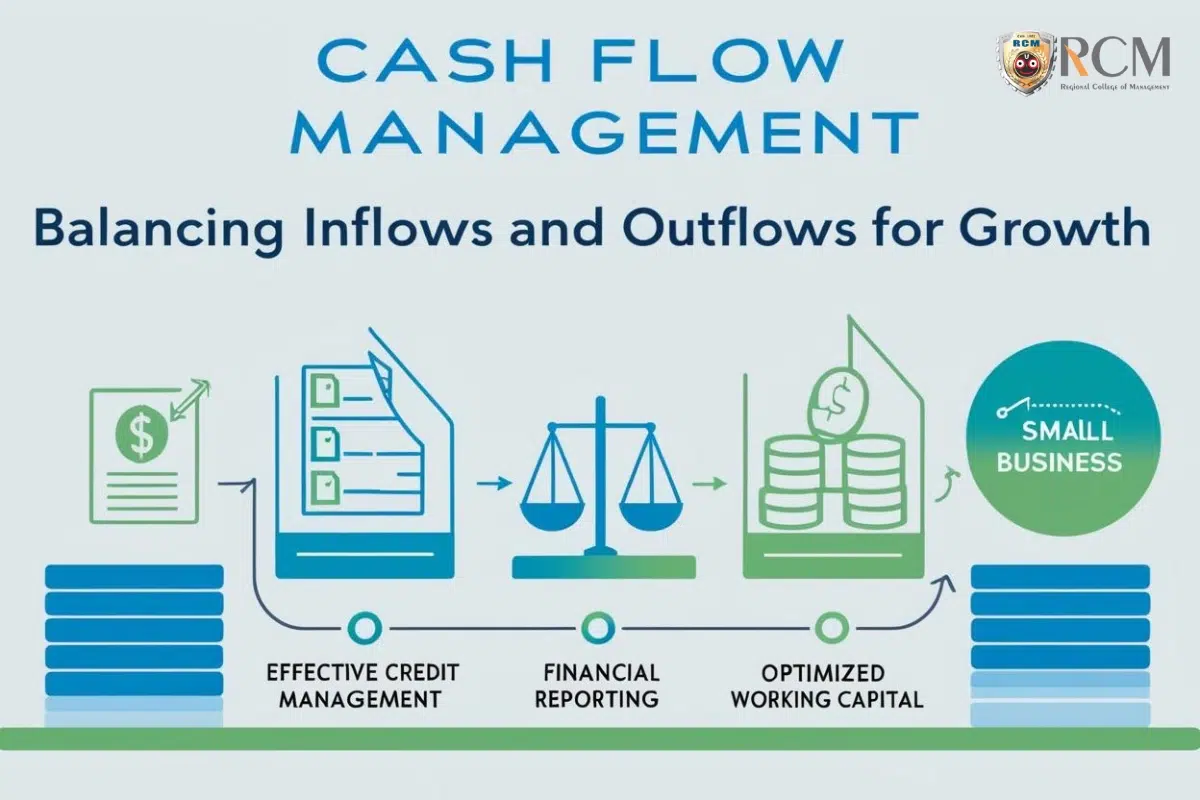

Managing small business finance is one of the most fundamental components of maintaining an effective business. For entrepreneurs, keeping up with cash flow can be challenging but is vital to sustaining operations and fostering growth. Below, we find practical strategies that small businesses can carry out to further develop their cash flow management and ensure financial stability.

1. Prioritize Cash Flow Forecasting

Compelling i cash flow forecasting assists businesses with foreseeing future cash flows and outflows, empowering them to plan. By utilizing this tool, small businesses can keep away from surprising shortages and assign assets more. Precise cash flow forecasting is essential for understanding your working capital needs and preparing for any financial contingencies.

2. Tighten Expense Control

Watching out for costs is essential for healthy cash flow management. Implementing strict expense control measures can reduce unnecessary spending and optimize resource utilization. Constantly looking into your business budgeting plan will likewise guarantee that your expenses line up with your financial goals

3. Improve Invoice Management

Late installments from clients can affect your cashflow. Streamlining your invoice management process by setting clear payment terms, offering incentives for early payments, and following up on overdue invoices can help improve cash inflows. Robotized invoicing tools can also save time and upgrade the productivity or invoice management

4. Focus on Profit Margin

Further developing your overall revenue can directly influence your income. Review your evaluating methodology to ensure your products or services are producing adequate profit. Look for ways to reduce production costs or haggle on better terms with enhance your profit margin without compromising quality.

5. Strengthen Credit Management

Effective credit management is essential for ensuring timely payments and reducing the risk of unmanageable debt. Assess the creditworthiness of your customers earlier than extending credit and set appropriate credit management limits. A sturdy credit management strategy can improve your small business finances and make contributions to consistent cashflow.

6. Optimize Working Capital

Your working capital is the soul of your business. Proficiently dealing with your ongoing resources and liabilities guarantees that you have adequate funds to cover everyday operations. Normal observing of working capital recognizes areas for development, for example, stock turnover or records payable cycles, which can decidedly affect your cashflow

7. Leverage Financial Tools and Financial Reporting

Utilizing monetary tools and keeping up with exact financial reporting can give important insights of knowledge into your small business finance. These tools empower you to follow your costs, screen your overall profit margin, and recognize potential income issues almost immediately. Comprehensive financial reporting ensures transparency and facilitates better decision-making.

8. Adopt Strategic Business Budgeting

A well-concepted business budgeting plan can act as a roadmap for reaching financial desires. It guarantees that sources are allotted efficiently and that there is minimal waste. Regularly updating your business budgeting plan assists you to adapt to converting market conditions and enhances your cashflow.

9. Explore Financing Options

In some cases, businesses might confront impermanent money shortages. In such cases, investigating funding options, for example, business loans, lines of credit, or invoice considering can help bridge the gap. However, it is fundamental to weigh the upsides and downsides of every option and guarantee that they align with your cash flow management

strategy

10. Cultivate Strong Relationships with Suppliers and Customers

Building strong relationships with your suppliers and clients can also decidedly impact on your cashflow. Negotiating favorable payment terms with suppliers and fostering loyalty among customers can result in smoother financial transactions and reduced delays.

Conclusion

Further developing cashflow management is not about reducing expenses; it’s about creating a balance between inflows and outflows while maintaining the growth trajectory of your business. By focusing on small business finance, executing effective credit management, keeping up with strong financial reporting, and optimizing working capital, small businesses can improve their financial wellbeing and guarantee long term achievement.

At Regional College of Management, we empower future entrepreneurs with practical knowledge in cash flow management and small business finance to ensure their ventures thrive in a competitive market.

Learn the art of business budgeting, financial reporting, and working capital optimization with RCM’s specialized programs designed to equip small business leaders with tools for success.

Join the innovative learning environment at RCM Bhubaneswar, where we focus on fostering skills like expense control, credit management, and cash flow forecasting to help businesses achieve financial stability